Hello from DefiPe. We are a decentralized crypto trading company, and we are thrilled to take you on a journey through the exciting world of cryptocurrencies and crypto trading. Our article will help you understand the evolution of cryptocurrencies, beginning with the basics. Join us as we investigate the fundamentals and complexities of this dynamic universe. Let’s go on this adventure together, unravelling the history of cryptocurrency from its birth. First, we understand how the concept of money originated in humans.

Introduction

Money is a fundamental component of human civilization, as it facilitates trade and the exchange of commodities and services. Money has evolved in a complex way, reflecting society’s shifting requirements and accomplishments. This blog explores the history of money, from its earliest origins to the current financial systems we use today.

Table of Contents

Barter System: The Beginning

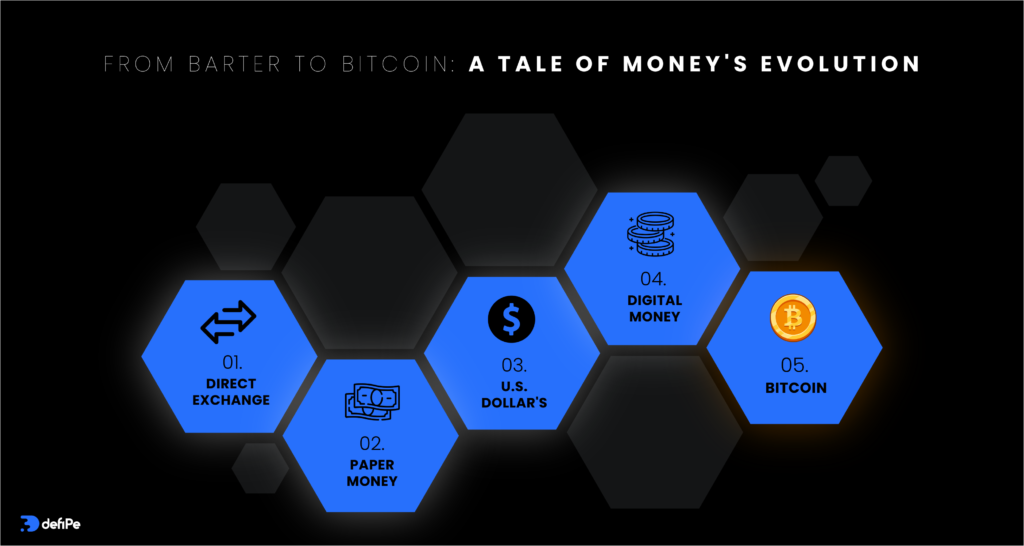

Before money, people relied on the barter system, in which products and services were exchanged directly. For example, a farmer would exchange a bag of wheat for a blacksmith’s pot. While this system worked in small towns, it had serious flaws, such as the need for a uniform measure of value and the difficulty in locating mutually advantageous deals.

Commodity Money: A New Era

To address the limits of barter, early societies adopted commodity money. This type of currency had intrinsic worth and included goods like as grain, cattle, and shells. For example, in ancient Mesopotamia, barley was a common medium of commerce. Similarly, cowrie shells were commonly used throughout Africa and Asia.

Metal Money: The Birth of Coins

Around 600 BCE, the Lydians in modern-day Turkey struck the first standardized coins out of electrum, a natural alloy of gold and silver. Coins quickly became popular because they were solid, portable, and had intrinsic value due to their metal composition. Ancient Greece and Rome used currency, which resulted in more sophisticated monetary systems and large trade networks.

Paper Money: The Chinese Innovation

The first recorded use of paper money dates back to the Tang Dynasty in China (618-907 CE). However, it was during the Song Dynasty (960-1279 CE) that paper money became widely used. Known as “jiaozi,” these early banknotes were backed by the government and helped facilitate trade over long distances.

The Renaissance and Banking

Europe’s banking and financial systems underwent tremendous breakthroughs throughout the Renaissance. The Medici dynasty in Florence pioneered contemporary banking methods such as bills of exchange and letters of credit. These tools enabled merchants to conduct business across multiple regions without carrying huge sums of cash, lowering the danger of theft.

The Gold Standard: Stability and Trust

In conclusion, the stories of the U.S. dollar and Bitcoin are like two different tales in the big book of money. The U.S. dollar’s story takes us from swapping cows to trusting the green piece of paper in our wallets, shaped by economic twists and turns.

Fiat Money: Trust in the Government

The early twentieth century saw the shift from the gold standard to fiat money, which has no intrinsic value and is not backed by tangible goods. Instead, fiat money gets its value from government decrees and popular faith. The United States abolished the gold standard in 1971, resulting in the widespread usage of fiat currencies worldwide. Today, the most popular type of currency is fiat money, which includes the US dollar, the euro, and the Japanese yen.

Digital Money: The Modern Revolution

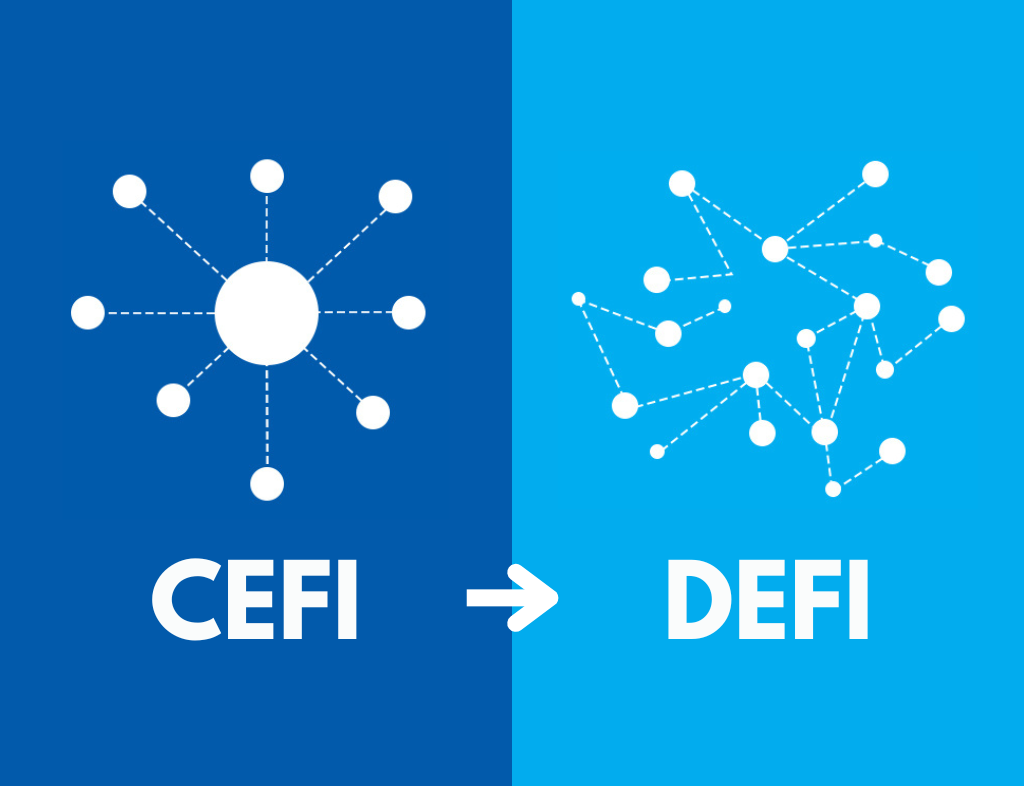

The late twentieth and early twenty-first centuries witnessed a dramatic transition towards digital money. Credit cards, online banking, and electronic payment systems such as PayPal have transformed the way consumers conduct purchases. The introduction of cryptocurrencies, such as Bitcoin, heralded a new type of digital money based on blockchain technology, promising decentralised and secure transactions without the need for intermediaries.

The Future of Money: Cryptocurrencies and Beyond

Cryptocurrencies are an important invention in the history of money. Bitcoin, founded in 2009 by an unnamed individual or group known as Satoshi Nakamoto, was the first decentralised cryptocurrency. Its underlying technology, blockchain, provides transparency and security, making it an appealing alternative to existing currencies. Thousands of cryptocurrencies exist today, including Ethereum, Ripple, and Litecoin, each with its own set of features and applications.

Central bank digital currencies (CBDCs) may also become more common in the future. Countries such as China and Sweden are already experimenting with CBDCs, which combine the advantages of digital transactions with the security and stability of government-backed currencies. These advancements could transform global financial institutions, making transactions faster, cheaper, and more secure.

Conclusion

The history of money demonstrates human creativity and flexibility. From the barter system to digital currencies, each stage in the evolution of money has answered society’s evolving demands and supported economic development. As we look to the future, innovations like as cryptocurrencies and CBDCs promise to further revolutionise our understanding and usage of money, making financial transactions more efficient and accessible to individuals throughout the world. Understanding this history not only provides insight into our past, but also prepares us for the wonderful opportunities that await us in the realm of money.

Share this content: